For many small and medium businesses across the U.S., getting access to capital can make or break growth. Traditional lending has often been slow, biased, and heavily dependent on credit history. Today, AI in Small Business Lending is changing that reality helping lenders make faster, smarter, and fairer decisions while giving entrepreneurs better access to funding.

Artificial Intelligence (AI) isn’t just a buzzword anymore. It’s actively reshaping how banks, fintech firms, and alternative lenders evaluate credit risk, process applications, and serve small business owners. Platforms like Committed to Capital are embracing AI to simplify and accelerate the lending experience for American businesses that need working capital now, not weeks later.

The Role of AI in Small Business Lending

AI in Small Business Lending helps automate and improve nearly every stage of the loan process from application to approval to risk monitoring. Instead of relying solely on static financial statements or credit scores, AI systems analyze hundreds of data points in seconds.

For instance, machine learning algorithms can evaluate:

- Transactional cash flow from accounting software

- Real-time sales data from payment processors

- Customer reviews and online reputation metrics

- Industry performance benchmarks

This data-driven approach gives lenders a 360-degree view of a business’s financial health, leading to more accurate lending decisions. As a result, small businesses that traditional banks may have overlooked can now access fair financing opportunities.

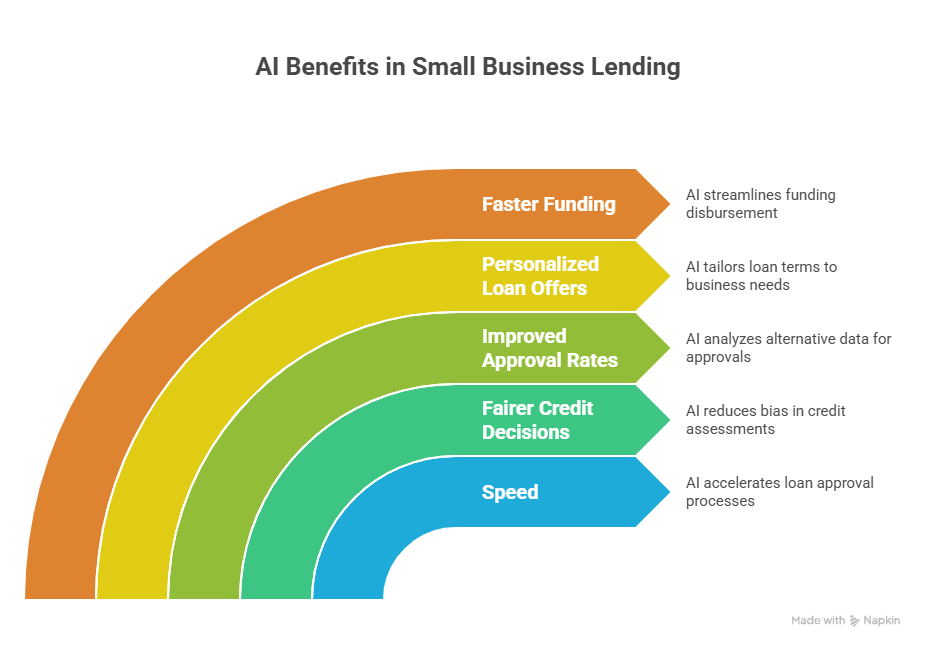

Why AI Matters for Small Business Borrowers

The most significant advantage of AI in Small Business Lending is speed. Traditional underwriting could take days or weeks; AI-powered models can approve loans within minutes. For business owners managing payroll, inventory, or seasonal cash flow, that speed is critical.

Other significant benefits include:

1. Fairer Credit Decisions

AI reduces human bias by focusing on measurable data instead of assumptions. It looks beyond credit scores to assess the full financial behavior of a business.

2. Improved Approval Rates

Many small businesses lack long credit histories. AI underwriting can analyze alternative data like utility payments, invoices, and digital transactions to approve more qualified borrowers.

3. Personalized Loan Offers

Machine learning identifies the best loan types, terms, and repayment schedules based on an individual company’s performance and risk profile.

4. Faster Funding

Automated workflows eliminate manual paperwork, allowing lenders to approve applications within hours and disburse funds much faster.

How Lenders Use AI to Make Better Decisions

Lenders implementing AI in Small Business Lending leverage predictive analytics and automation to manage risk effectively. Instead of manually reviewing every application, AI tools flag inconsistencies, verify data automatically, and calculate risk scores using historical patterns.

For example, predictive models can forecast a borrower’s likelihood of default by analyzing cash flow trends, market volatility, and even seasonal fluctuations. Natural language processing (NLP) tools can read financial documents or tax filings instantly, freeing up human underwriters to focus on complex cases.

This combination of speed, precision, and scalability allows lenders to serve more small businesses without compromising accuracy or compliance.

How AI Expands Access to Capital

Access to capital has long been a challenge for minority-owned, women-owned, and rural businesses. AI’s ability to evaluate nontraditional data sources helps close that gap. Instead of penalizing entrepreneurs with limited credit history, it highlights positive indicators of performance.

For instance, consistent online sales, customer retention rates, or on-time vendor payments can all serve as strong signals of creditworthiness.AI in Small Business Lending democratizes access to funding, giving every entrepreneur a fair opportunity to grow.

Committed to Capital shares the same mission- we make funding inclusive, transparent, and efficient. Using AI-powered tools, we extend credit responsibly to businesses that traditional lenders often overlook.

The Future of AI in Lending

As technology advances, AI in Small Business Lending will continue evolving beyond credit scoring. Future systems will use deep learning to assess new forms of data, such as social engagement, real-time inventory analytics, and even sentiment analysis, to predict a business’s potential success.

AI chatbots are already assisting borrowers by guiding them through applications and answering questions instantly. Soon, voice-enabled assistants may handle document verification and compliance steps automatically.

However, with innovation comes responsibility. Lenders must ensure transparency, ethical AI usage, and data privacy. Committed to Capital believes in using technology that empowers businesses while maintaining trust, fairness, and accountability.

Practical Tips for Small Businesses Seeking AI-Driven Loans

If you’re a small business owner exploring AI-powered lending platforms, here’s how to prepare:

- Keep your financial data organized — Sync your accounting tools, bank statements, and sales systems. AI performs best with accurate, real-time information.

- Build digital visibility — Maintain updated business listings, customer reviews, and transaction histories. Many AI systems use these as alternative credit signals.

- Understand the loan terms — Even with automation, always review your repayment structure, fees, and timelines carefully.

- Choose trusted lenders — Partner with established, transparent companies like Committed to Capital that combine human expertise with AI innovation.

By following these steps, you’ll position your business for smoother approval and better loan offers.

The rise of AI in Small Business Lending marks a turning point in how entrepreneurs access capital. With faster decision-making, data-driven evaluations, and inclusive lending practices, AI is creating a more equitable financial landscape for small and medium-sized businesses across America.

At Committed to Capital, technology and trust go hand in hand. Our mission is to help U.S. businesses secure the funding they deserve quickly, fairly, and responsibly. As AI continues to evolve, it will not replace human judgment but enhance it, empowering lenders to make smarter choices and empowering business owners to grow with confidence.