Securing loan approval with bad credit may feel like climbing a steep hill, but it’s not impossible. Many small and medium-sized business owners face this challenge. Having a low credit score, whether it comes from past financial mistakes, unexpected emergencies, or limited credit history, does not lock you out of funding. What it does mean is that you’ll need a smarter, more strategic approach to get approved.

In this guide, we’ll explore practical strategies, loan types, and alternative funding options so that you can move forward confidently. Our goal is to help you not only understand the possibilities of loan approval with bad credit but also to position your business for long-term success.

Why Loan Approval with Bad Credit Is Still Possible

Banks and lenders look at more than just your credit score. While a high score makes the process smoother, lenders also consider:

- Income stability – Is your business generating regular revenue?

- Employment status – Are you self-employed, or do you have contracts that prove steady work?

- Collateral – Do you have assets to secure the loan?

- Debt-to-income ratio – How much existing debt are you already carrying?

The reality is that loan approval with bad credit often comes with higher interest rates or stricter terms. However, by demonstrating stability, responsibility, and preparedness, you can still secure the capital your business needs.

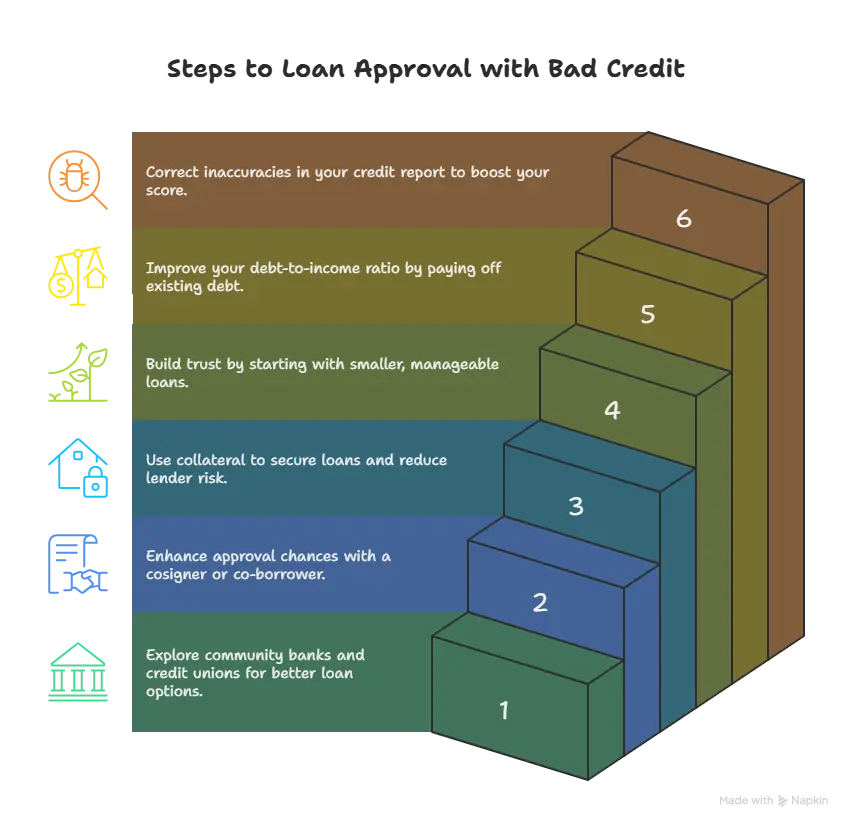

How to Improve Your Chances of Loan Approval with Bad Credit

Here are proven strategies you can apply right now:

1. Find Lenders Who Work with Bad Credit

Not all lenders are the same. Community banks, online lenders, and credit unions often provide more flexible options than traditional big banks. Credit unions in particular tend to have a community-first approach, making loan approval with bad credit more realistic.

2. Apply with a Cosigner or Co-Borrower

If you can bring someone with strong credit to back your application, your chances improve dramatically. A cosigner shares responsibility for repayment, which reduces risk for the lender and can also lower your interest rate.

3. Choose Secured Loans

Secured loans require you to pledge collateral, such as business equipment, real estate, or savings accounts. Since the lender has something to fall back on, they’re more likely to approve your request, even with bad credit.

4. Start Small and Build Trust

Instead of applying for a large loan right away, consider requesting a smaller amount. Smaller loans are less risky for lenders and easier to approve. Once you repay consistently, you’ll build credibility for larger loans in the future.

5. Reduce Your Existing Debt

Paying off current debt can improve your debt-to-income ratio, making you a more attractive borrower. Even paying down a small portion shows responsibility and can strengthen your case for loan approval, especially if you have bad credit.

6. Fix Credit Report Errors

Surprisingly, many credit reports contain mistakes. Request free copies from Equifax, Experian, and TransUnion, and dispute inaccuracies. A quick correction could raise your score just enough to unlock new loan opportunities.

Committed to Capital makes loan approval with bad credit possible by offering flexible options tailored to your needs. Apply today and take the first step toward rebuilding your financial future.

Types of Loans Available for Bad Credit

If you’re worried about rejection, it helps to know which loans are more accessible when dealing with bad credit. Here are some options:

1. Unsecured Personal Loans

Some lenders, particularly online platforms, offer unsecured loans to borrowers with low credit scores. While the rates may be higher, they provide a lifeline for immediate funding needs.

2. Secured Business Loans

By pledging collateral, you make it easier for lenders to trust your application. Collateral reduces their risk and gives you a better shot at loan approval with bad credit.

3. Credit-Builder Loans

These accounts help you rebuild your credit. Lenders place the funds in an account and release them after you make consistent, on-time payments. They report each payment to credit bureaus, which gradually improves your score.

4. FHA Loans

If you’re seeking a mortgage or commercial property loan, FHA loans may work in your favor. With flexible requirements, they sometimes accept scores as low as 580.

5. Home Equity Loans or HELOCs

If you own property, tapping into your home equity is another way to get financing. This is a secured option, and lenders are often more willing to grant loan approval with bad credit when equity is involved.

Alternatives to Loans for Bad Credit Borrowers

Sometimes the best option isn’t a traditional loan. Here are alternatives to explore:

- Credit Cards for Bad Credit – Secured credit cards can help rebuild your score and provide small amounts of working capital.

- Borrow from Friends or Family – With clear terms, this can be a flexible and affordable option.

- Payday Alternative Loans (PALs) – Offered by credit unions, PALs are safer and cheaper than payday loans.

- Buy Now, Pay Later Plans – For smaller purchases, this allows you to split payments without large upfront costs.

- Cash Advance Apps – Useful for immediate needs, though they may have small fees.

Expert Tips to Strengthen Your Application

- Prepare Documentation – Tax returns, bank statements, invoices, and proof of revenue help show you’re financially responsible.

- Explain Your Situation – Many lenders listen if you can explain why your credit is low and how you’re improving it.

- Highlight Your Business Growth Plan – Showing a roadmap for growth gives lenders confidence in your ability to repay.

- Work with a Financial Advisor – Expert guidance can help match you with lenders who are open to loan approval with bad credit.

Final Thoughts

Getting loan approval with bad credit isn’t easy, but it’s far from impossible. By understanding your options, improving your financial profile, and targeting lenders who specialize in working with borrowers like you, you can secure the capital needed to move your business forward.

Every step you take whether reducing debt, fixing errors, or choosing secured loans moves you closer to approval. Remember: your credit score is just one part of your story. Show lenders that you’re committed to repaying responsibly, and opportunities will open up.