Why Business Loans Matter in 2026

The year 2026 marks a defining moment for small and medium sized businesses. Rising costs, shifting interest rates, rapid advances in technology, and evolving customer expectations are reshaping how entrepreneurs think and act. In this climate, reliable access to funding is not optional. It has become the foundation for both stability and long term growth.

Whether you are launching a technology startup, running a neighborhood restaurant, or expanding a manufacturing company, every financial choice you make today will shape the future of your business. Business loans continue to be one of the most effective ways to secure the capital needed for daily operations, strategic expansion, and innovation.

This complete guide for business loans in 2026 is designed to give you clarity. You will learn how loans work today, which options are available, what lenders look for, and how you can make better funding choices. By the end, you will be equipped with both knowledge and actionable steps that directly benefit your business.

Current State of Business Lending

Small and medium businesses form the backbone of the American economy. In 2026, lending conditions reflect both opportunity and caution.

Interest rates remain higher than pre pandemic levels but are more stable than the fluctuations seen in previous years. Traditional banks continue to offer secured loans but they compete with fintech lenders and community development institutions that provide faster approvals and flexible terms.

For entrepreneurs, this means that business loans are widely available but approval depends on preparation. Lenders now expect businesses to present clear financial statements, cash flow projections, and repayment capacity before approving applications.

Why Business Loans Are Essential for SMBs

Business loans serve as the lifeblood of growth and stability. Without financing, many owners struggle to pay employees, buy inventory, invest in marketing, or expand operations.

In 2026, the importance of loans is even more visible. Companies need financing to compete in digital markets, adopt automation tools, and manage increasing supply chain costs. Having the right loan in place allows you to stabilize operations while preparing for long term success.

With Committed to Capital by your side, getting the funding you need to grow, compete, and succeed in 2026 has never been easier.

How to Choose the Right Loan in 2026

Before applying, you should match the type of loan with your specific business need.

Step one is defining your goal. Are you covering payroll, purchasing equipment, or acquiring a new location?

Step two is understanding the difference between short term and long term financing. Term loans give you a fixed repayment schedule while lines of credit provide revolving access to funds.

Step three is checking readiness. Lenders want to see your time in business, annual revenue, credit score, and collateral options.

Step four is evaluating cost. Do not just look at the advertised interest rate. Understand fees, origination charges, factor rates, and possible prepayment penalties.

Step five is considering speed. If you need funds immediately, you may choose a faster online option. If you can wait, traditional banks or SBA loans may provide better rates.

Secure the right loan now contact Committed to Capital for expert advice, faster approvals, and customized funding solutions for your small business.

Comparison Table of Business Loan Options in 2026

| Loan Type | Typical Amount | Term Length | Funding Speed | Best For |

| SBA 7a Loan | 250k to 5M | Up to 25 years | 4 to 8 weeks | Acquisitions, expansion |

| SBA 504 Loan | 500k to 5M | 10 to 25 years | 6 to 10 weeks | Real estate or equipment purchase |

| SBA Express Loan | Up to 500k | Up to 10 years | 2 to 3 weeks | Smaller projects |

| SBA Microloan | Up to 50k | Up to 6 years | 2 to 6 weeks | Startups and microbusinesses |

| Bank Term Loan | 100k to 5M | 3 to 10 years | 4 to 6 weeks | Established SMBs |

| Business Line of Credit | 50k to 500k | Revolving | 1 to 3 weeks | Cash flow management |

| Equipment Financing | 50k to 1M | 3 to 7 years | 1 to 3 weeks | Buying or leasing equipment |

| Invoice Financing | 10k to 1M | 1 to 6 months | 3 to 7 days | B2B companies |

| Merchant Cash Advance | 5k to 500k | 3 to 12 months | 1 to 3 days | Quick funding |

| Revenue Based Financing | 50k to 2M | Until paid off | 1 to 2 weeks | SaaS and ecommerce |

| Asset Based Lending | 100k to 5M | 1 to 5 years | 3 to 5 weeks | Growth financing |

| Commercial Real Estate Loan | 500k to 10M | 10 to 25 years | 5 to 8 weeks | Buying property |

| Purchase Order Financing | 50k to 2M | Until paid | 2 to 3 weeks | Large order fulfillment |

| Startup Loan | Up to 250k | 1 to 5 years | 3 to 5 weeks | New businesses |

| Franchise Financing | 50k to 500k | 3 to 10 years | 2 to 4 weeks | Franchise startups |

| Export Working Capital | 100k to 2M | Up to 3 years | 3 to 6 weeks | Exporters |

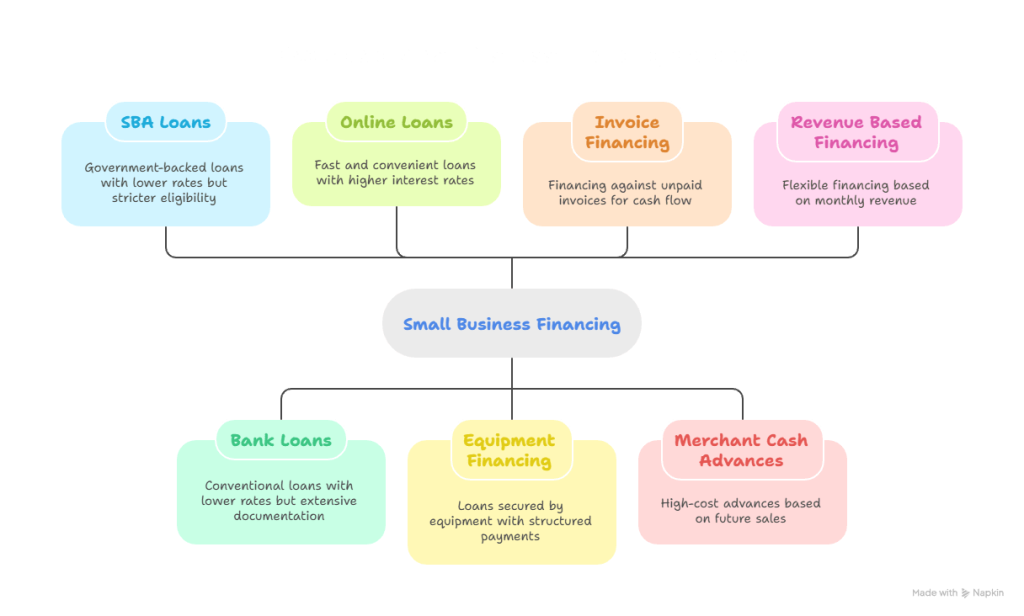

Expanded Types of Loans

SBA Loans

The Small Business Administration continues to support American entrepreneurs through the 7a, 504, Express, and Microloan programs. These loans provide lower rates and longer repayment terms because they are partially guaranteed by the government. The tradeoff is stricter eligibility and longer approval timelines.

Bank Loans and Credit Unions

Conventional loans remain the best choice for established businesses with solid revenue and strong credit. Banks provide term loans and lines of credit at lower rates compared to alternative lenders but require extensive documentation and often collateral.

Online and Fintech Loans

Online lenders offer speed and convenience. Applications are streamlined, funding is fast, and requirements are flexible. However, interest rates are usually higher. These loans are suitable for businesses that need quick access to cash or cannot qualify for bank financing.

Equipment Financing

This option is ideal when purchasing machinery, vehicles, or technology. The equipment itself acts as collateral which makes approval easier. Payments are structured to match the useful life of the asset.

Invoice Financing and Factoring

If your business invoices other companies, these tools allow you to unlock cash tied up in receivables. Financing lets you borrow against unpaid invoices, while factoring means selling them outright. This helps maintain cash flow but can be expensive.

Merchant Cash Advances

An MCA gives you a lump sum in exchange for a percentage of future sales. While approval is fast, the cost is extremely high. It should be used only as a last resort for urgent short term needs.

Revenue Based Financing

This method is increasingly popular among SaaS and ecommerce companies. Payments are based on a fixed percentage of monthly revenue which means the repayment schedule adjusts with your income. It provides flexibility but can extend repayment if sales are weak.

Asset Based Lending

With ABL, the loan is secured by receivables, inventory, or other business assets. This provides higher amounts for growth but requires ongoing reporting and monitoring by lenders.

Commercial Real Estate Loans

These loans fund property purchases, expansions, or refinancing. They usually come with long terms and require property as collateral. Businesses should watch loan to value ratios and DSCR requirements.

Purchase Order Financing

If your company receives a large order but lacks the funds to fulfill it, PO financing provides the capital needed. It is useful in manufacturing and wholesale sectors but comes with high costs.

Startup and Franchise Loans

Startups may rely on CDFIs, microloans, or online lenders since they often lack the history banks require. Franchise loans leverage brand strength and usually come with packages tailored to new franchisees. Startup loans give new business owners the capital they need to launch and grow when traditional banks may not approve early-stage companies.

Export Working Capital

For businesses involved in international trade, this loan covers the gap between fulfilling orders and receiving overseas payments. The SBA supports some of these programs.

Costs, Terms, and Risks

Every loan has tradeoffs. Understanding the fine print is essential.

Always compare APR instead of factor rate. Check for origination, underwriting, or renewal fees. Consider repayment schedules since daily or weekly payments can put pressure on cash flow. Review collateral requirements, UCC filings, and personal guarantees. Avoid hidden prepayment penalties that lock you into expensive loans.

Documentation Checklist

Prepare these before applying to speed approval:

Business tax returns for the last two years, personal tax returns, profit and loss statements, balance sheets, bank statements, ownership documents, business plan, revenue projections, accounts receivable reports, and collateral documentation.

Consistency and accuracy increase your chances of approval.

What Lenders Look For in 2026

Lenders review cash flow strength, DSCR, time in business, annual revenue, credit score, and industry risk. They prefer businesses with stable income, organized finances, and a clear repayment plan.

Real World Scenarios

A restaurant in Chicago can use a line of credit to cover payroll in slow months while applying for an SBA 504 loan to purchase new kitchen equipment.

An ecommerce brand in Austin may use invoice financing to handle seasonal inventory surges while relying on revenue based financing to support ad campaigns.

A manufacturer in Ohio may secure an SBA 7a loan for expansion while using asset based lending for working capital.

Common Pitfalls to Avoid

Do not stack multiple high cost loans with daily payments. Do not sign agreements without understanding factor rates. Avoid over leveraging collateral. Be cautious with merchant cash advances which can drain cash flow.

Tips to Lower Loan Costs

Build a banking relationship early. Keep books clean and reconciled. Improve DSCR by reducing unnecessary expenses. Refinance high cost loans into lower rate products once eligible. Use loans strategically instead of reactively.

Final Thoughts

The complete guide for business loans in 2026 shows that access to capital remains vital for American small and medium businesses. With so many loan types available, the key is matching the right financing to your business needs while balancing cost, speed, and risk.

Committed to Capital helps business owners across the United States evaluate options, compare lenders, and secure funding with confidence. By preparing your documents, understanding your choices, and applying strategically, you can unlock the financial tools to grow your company and achieve lasting success.