Retail and ecommerce businesses are a core part of Pennsylvania’s economy. From independent storefronts in Philadelphia and Pittsburgh to fast-growing ecommerce brands shipping products across the country, business owners throughout Pennsylvania depend on reliable access to capital to operate, grow, and adapt to changing market conditions.

Every stage of a retail or ecommerce business requires funding. Inventory purchases, payroll, marketing campaigns, seasonal demand spikes, fulfillment costs, rent, and technology upgrades all place pressure on cash flow. Yet many Pennsylvania business owners struggle not because financing is unavailable, but because it is unclear which option fits their business model, revenue cycle, and long-term goals.

This guide provides practical, easy-to-understand retail and ecommerce business financing tips in Pennsylvania to help business owners make confident decisions, avoid costly mistakes, and use financing as a tool for sustainable growth.

- Retail and ecommerce financing should match your cash-flow cycle (seasonal vs. variable).

- The best options for most Pennsylvania businesses are lines of credit (flexible), term loans (planned growth), and SBA loans (best rates, slower approval).

- Apply before peak season and keep documents ready to improve approval speed and terms.

Understanding Retail and Ecommerce Financing in PA

Retail and ecommerce financing works differently than traditional small business lending. Lenders do not view a brick-and-mortar retail store the same way they view an online business selling through Shopify, Amazon, or other ecommerce platforms. Each model has unique cash flow patterns, risks, and growth dynamics.

In Pennsylvania, lenders typically evaluate factors such as monthly revenue consistency, transaction volume, inventory turnover, customer demand, and time in business. Retail businesses often generate steady in-person sales but may experience seasonal slowdowns or higher fixed expenses like rent and staffing. Ecommerce businesses, on the other hand, may scale quickly but face fluctuating revenue tied to advertising performance, shipping costs, and return rates.

Understanding how your business is evaluated helps you choose financing that aligns with how money moves through your operation, rather than forcing your business into a funding structure that creates stress.

In Pennsylvania, lenders typically review:

- Monthly revenue consistency

- Transaction volume

- Inventory turnover

- Customer demand trends

- Time in business

Choosing financing that aligns with how money moves through your business reduces stress and protects cash flow.

Which Financing Fits Your Need?

| Business Need | Best Financing Option |

| Inventory for peak season | Business line of credit or term loan |

| Marketing & ads (ecommerce) | Revenue-based financing (if sales fluctuate) |

| Equipment, vehicles, or technology | Equipment financing |

| Store expansion or renovation | Term loan or SBA loan |

| Buying a building | Commercial mortgage or SBA 504 |

| Waiting on customer invoices | Invoice factoring |

Common Financing Challenges for Pennsylvania Retail and Ecommerce Businesses

Many Pennsylvania retail and ecommerce businesses face financing challenges even when sales are strong. One of the most common issues is cash flow timing. Retailers may sell products quickly but still wait weeks to pay suppliers or cover overhead. Ecommerce businesses often spend heavily on marketing upfront and only see returns later, creating temporary cash gaps.

Another major challenge is misunderstanding credit requirements. Many business owners believe that less-than-perfect personal credit automatically disqualifies them from funding. In reality, many retail and ecommerce financing options focus more on revenue performance and business activity than on credit scores alone.

Documentation issues also slow down approvals. Incomplete bank statements, unclear revenue reporting, or inconsistent bookkeeping can delay or weaken applications. Preparing financial records in advance significantly improves approval speed and terms.

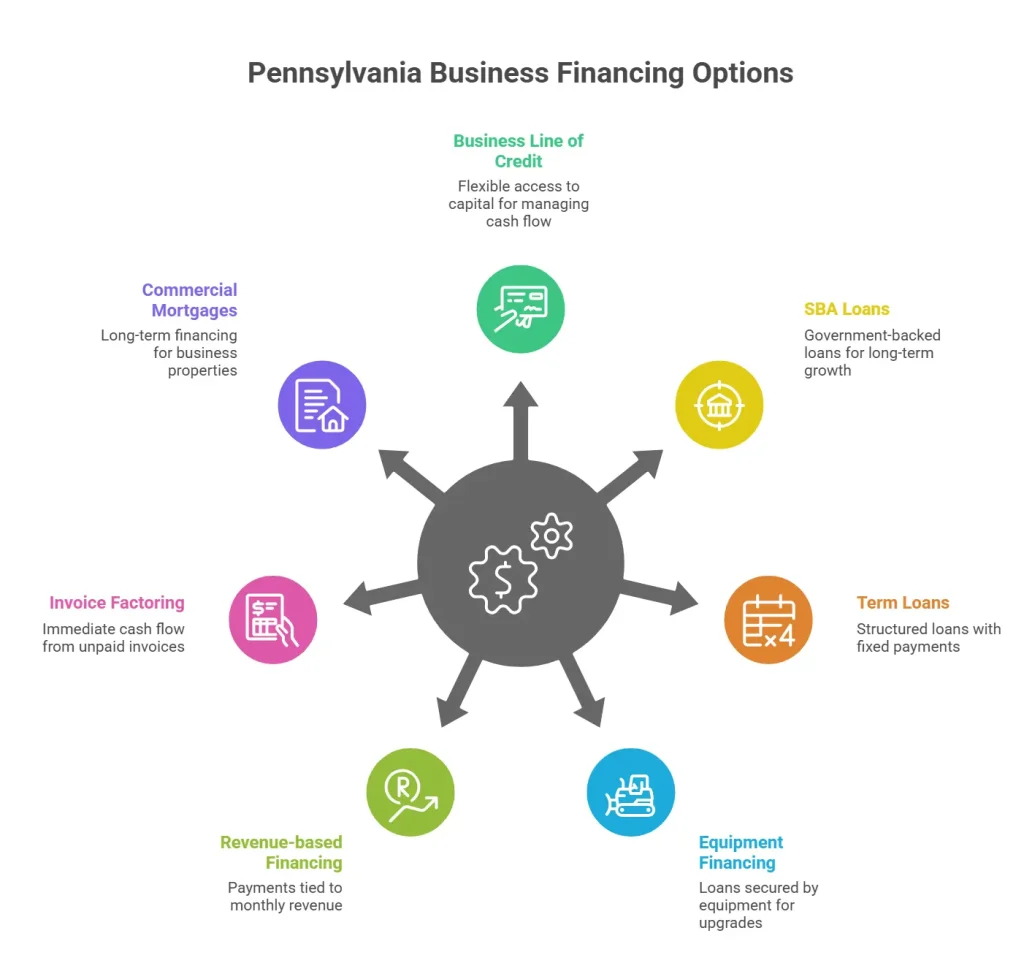

Financing Options Available to Retail and Ecommerce Businesses in Pennsylvania

Pennsylvania business owners have access to a wide range of financing tools, each designed to support different needs. Business term loans are commonly used for larger investments such as store expansions, renovations, or major inventory purchases. These loans provide a lump sum with structured repayment over time, making them suitable for long-term growth plans.

1. Business Line of Credit

A business line of credit provides flexible access to capital that small business owners can use as needed. Instead of receiving a lump sum, you’re approved for a credit limit and only pay interest on the funds you draw. This option is ideal for managing cash flow gaps, covering short-term expenses, handling seasonal fluctuations, or responding to unexpected costs. With fast access, revolving availability, and reusable funds, a business line of credit gives companies the financial flexibility to operate smoothly without overborrowing.

Pros: Flexible, reusable, interest only on funds used

Cons: Variable rates can increase costs if mismanaged

2. SBA 7(a) & 504 Loans

SBA 7(a) and SBA 504 loans are government-backed financing options designed to support small business growth with longer terms and lower down payments. These loans are commonly used for real estate purchases, equipment acquisition, working capital, and business expansion. SBA loans offer stability and affordability, making them well-suited for established businesses planning long-term investments. While the approval process is more detailed, the benefits often include favorable rates and extended repayment periods.

Pros: Lower rates, longer repayment terms

Cons: Longer approval time and more documentation

3. Term Loans

Term loans offer a straightforward financing solution with a fixed loan amount, predictable payments, and a defined repayment schedule. They are commonly used for business expansion, major purchases, refinancing existing debt, or long-term investments. Term loans provide stability and clarity, making them a strong option for businesses that want structured repayment and clear timelines. Depending on qualifications, businesses can access competitive rates and flexible terms aligned with their growth goals.

Pros: Predictable payments and clear timeline

Cons: Less flexibility during slower months

4. Equipment Financing

Equipment financing allows businesses to purchase or upgrade essential equipment without tying up large amounts of cash. The equipment itself typically serves as collateral, making this option more accessible for many businesses. From machinery and vehicles to technology and specialized tools, equipment financing helps companies stay operational, efficient, and competitive while preserving working capital. Payments are structured to match business cash flow, supporting growth without financial strain.

Pros: Preserves cash and enables fast upgrades

Cons: Limited to equipment value and lifespan

5. Revenue-based Financing

Revenue-based financing offers funding that is repaid as a percentage of monthly revenue, allowing payments to adjust with business performance. This flexible structure makes it an attractive option for businesses with fluctuating income, such as ecommerce and service-based companies. There are no fixed monthly payments, and repayment aligns directly with cash flow, helping businesses grow without the pressure of rigid loan schedules or equity dilution.

Pros: Payments adjust with revenue

Cons: Total repayment cost can be higher over time

6. Invoice Factoring

Factoring provides immediate cash flow by converting unpaid invoices into working capital. Instead of waiting weeks or months for customer payments, businesses can sell their receivables and access funds quickly. This option is especially useful for companies with long payment cycles or rapid growth that strains cash flow. Factoring helps maintain operations, cover payroll, and fund ongoing expenses without taking on traditional debt.

Pros: Improves cash flow without traditional debt

Cons: Fees reduce total invoice value

7. Commercial Mortgages

Commercial mortgages provide long-term financing for purchasing, refinancing, or renovating business properties such as office buildings, retail spaces, warehouses, and mixed-use real estate. This financing option allows business owners and investors to secure property ownership while preserving cash flow for daily operations and future growth. With structured repayment terms, competitive rates, and loan amounts based on property value and income potential, commercial mortgages support stability and expansion.

Pros: Builds equity and long-term stability

Cons: Requires down payment and longer approval process

How Lenders Evaluate Retail vs. Ecommerce Businesses in PA

Lenders assess retail and ecommerce businesses using different criteria. Retail businesses are often evaluated based on consistent monthly sales, inventory turnover, operating margins, location stability, and seasonal performance. A well-established retail location with predictable revenue can be attractive to lenders, even if growth is gradual.

Ecommerce businesses are typically assessed using platform data and performance metrics. Lenders may review sales history from ecommerce platforms, refund and chargeback rates, customer acquisition efficiency, average order value, repeat purchase behavior, and fulfillment costs. Clean, well-documented sales data can significantly strengthen an ecommerce financing application.

Understanding what lenders look for allows business owners to prepare stronger applications and avoid unnecessary delays.

Retail businesses are typically evaluated based on:

- Consistent monthly sales

- Inventory turnover

- Location stability

- Seasonal performance

Ecommerce businesses are evaluated using:

- Platform sales data

- Refund and chargeback rates

- Customer acquisition costs

Average order value and repeat purchases

Smart Financing Tips for Retail Businesses in PA

Retail business owners benefit most when financing is planned in advance rather than used reactively. Applying for funding before peak seasons ensures capital is available when demand increases. Clean financial records, including organized bank statements and consistent revenue tracking, improve approval outcomes.

It is also important for retailers to match repayment terms to sales cycles. Financing should support growth without creating pressure during slower months. Overborrowing can strain cash flow, while right-sized financing supports stability and expansion.

Working with financing partners who understand Pennsylvania’s retail environment, including local demand patterns and operating costs, can improve both funding structure and long-term results.

Pennsylvania Business Funding Resources

- PA Business One-Stop

- Pennsylvania Department of Community and Economic Development

- Small Business Development Centers

- Ben Franklin Technology Partners

How Pennsylvania’s Business Environment Influences Financing Decisions

Pennsylvania offers a diverse business landscape that affects how lenders assess risk and opportunity. Retailers in major cities may require higher upfront capital but benefit from stronger foot traffic and customer density. Suburban and regional businesses often demonstrate steadier sales patterns.

Ecommerce businesses benefit from Pennsylvania’s strategic location along the East Coast, which supports efficient shipping and fulfillment. Lenders often consider these logistical advantages when evaluating ecommerce businesses operating in the state.

Understanding how location impacts lender perception helps business owners position their applications more effectively.

Financing Application Checklist

- Last 3–6 months of bank statements

- Profit & Loss statement (P&L)

- Business tax returns (if available)

- ID and basic business info (EIN)

- Ecommerce sellers: Shopify/Amazon reports + refund/chargeback rate

Why Timing Matters When Applying for Business Financing

One of the most common mistakes business owners make is waiting until cash flow becomes tight before seeking financing. Applying under pressure limits options and often leads to higher costs.

The strongest financing terms are usually available when revenue is stable and sales trends are positive. Seasonal businesses in Pennsylvania should apply for financing before high-demand periods, not during them. Proactive planning creates flexibility and improves negotiating power.

Avoiding Costly Financing Mistakes

Choosing financing based solely on speed can lead to long-term problems. Fast funding is appealing, but unclear repayment terms or high total costs can damage cash flow. Business owners should carefully review interest rates, fees, repayment frequency, and total repayment amounts.

Applying to multiple lenders without a strategy can also hurt credibility. A focused, well-prepared approach produces better results than rushed applications.

Working With the Right Financing Partner Matters

The right financing partner does more than provide capital. They understand retail and ecommerce business models, recognize cash flow realities, and offer guidance tailored to Pennsylvania market conditions.

A strong partner prioritizes transparency, customization, and long-term success rather than one-time transactions.

How Committed to Capital Supports Pennsylvania Businesses

Committed to Capital works closely with retail and ecommerce businesses across Pennsylvania to deliver financing solutions built around real business needs. Instead of offering one-size-fits-all products, the team evaluates revenue, cash flow, and growth goals to recommend suitable funding options.

Whether a business needs working capital, inventory financing, or growth-focused funding, Committed to Capital simplifies the process with clear terms and efficient decision-making.

If you’re a Pennsylvania retail or ecommerce business owner exploring financing options, visit our website to receive personalized guidance and access funding solutions designed to support sustainable growth.

Final Thoughts on Retail and Ecommerce Financing in Pennsylvania

Retail and ecommerce businesses succeed when financing supports strategy rather than creating stress. By understanding funding options, preparing documentation, applying at the right time, and choosing the right partner, Pennsylvania business owners can turn financing into a powerful growth tool.

With informed planning and the right support, access to capital becomes an opportunity for stability, expansion, and long-term success not a burden.